An offshore bank account gives you a higher level of freedom, security, and profitability. Additionally, tax heavens banking laws are strict, and disclosing any information about a bank account or its owner is considered a crime. So it makes sense to operate an overseas bank account where it is safe from local financial authorities, creditors, competitors, ex-spouses, and others who may want to seize your fortune.

Best Easiest Countries to Open An Offshore Bank Account

We’ve compiled a list of the best easiest countries to open offshore bank accounts with no hassles. Now, you can protect your assets and keep your money safe.

1.Switzerland

Switzerland has garnered a reputation for money laundering as one of the strongest offshore banks. The country’s stringent privacy regulations are one of the critical reasons for all of this, and it dates back to almost three centuries. Switzerland’s bank doesn’t offer offshore bank accounts for individuals anymore, except you will deposit a considerable amount of at least 100k$ to a half-million of $$$ (100k CHF to 500k CHF). We advise you to talk with your financial advisor before any move for a smooth process.

Without your permission, Swiss law bans bankers from sharing any details about your account. However, illegal actions are the only exception to this privacy rule, and there is a submission to the international tax authorities once a year to discourage tax dodging. After Panama Papers and Pandora Paper’s gates, the rules have changed, and the country has become more open to sharing data with international law enforcement and regulators.

Switzerland’s position as a safe investment is another factor behind Switzerland’s reputation as a significant offshoring and assets protection destination. Switzerland’s political and legal climate is stable, and the Swiss Association of Bankers governs all financial institutions. High capital adequacy is also expected by Swiss law. The SBA amended the Depositor Security Agreement in 2004; this arrangement assures that depositors can collect their privileged demands in case of bank failures.

Pros

- Asset Protection and Hospitable Legal Climate

- No Interest or Inheritance Taxes

- Access to Assets and Privileges in Case of Bank Failures

Cons

- High Capital Adequacy

- Submission to the international tax authorities

2.Singapore

Your best option may be Singapore because it is a thriving financial center with an international reputation. It provides reasonably simple accounting procedures as you can open an account without traveling to Singapore. Due to its status as a stable, convenient way of storing assets, people prefer this small country to be trustworthy for their investments.

Singapore banking industry has stringent rules for privacy & security so you can make sure your fortune is well-protected. In addition to this, their institutions have high technology that provides both confidentiality & convenient access to money in different currencies, and it can reduce the inconvenience of higher currency fluctuations.

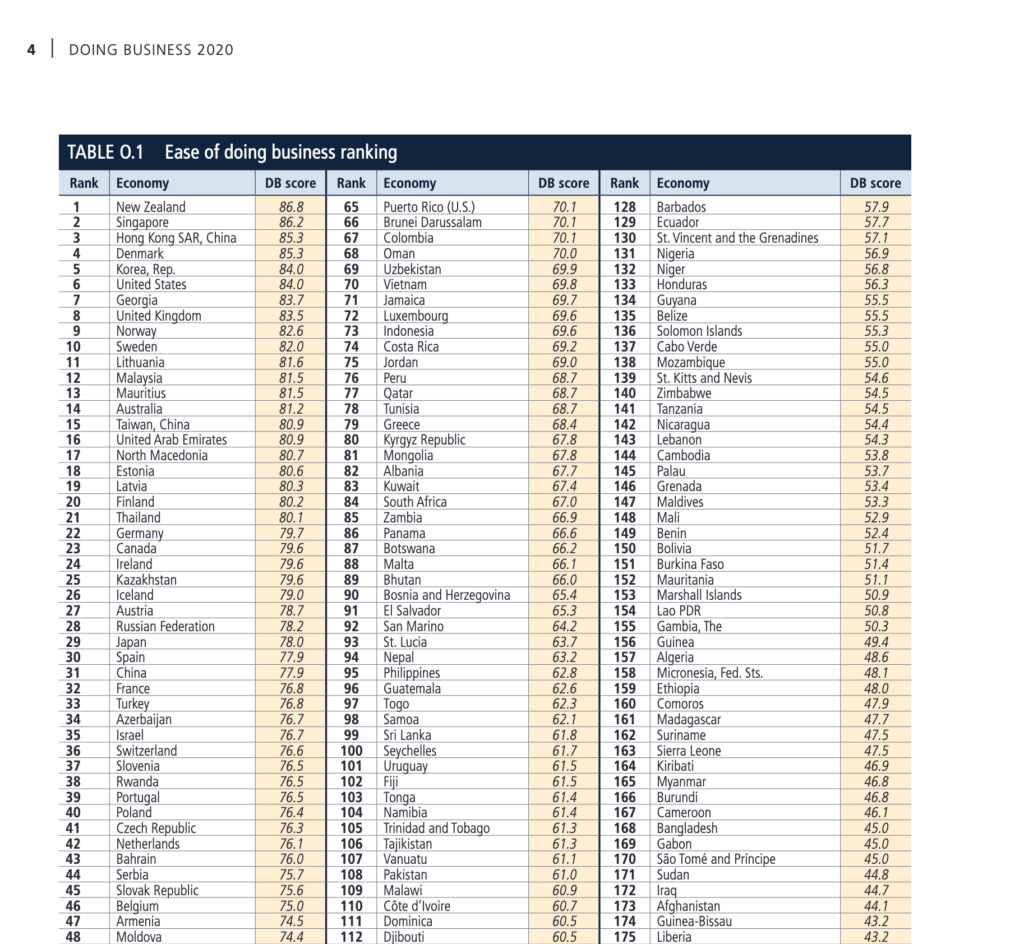

Singapore banks also have professional teams for wealth management. All experts are committed to helping you to discover your money’s right investment plan. In 2020, this city-state was placed 2nd by the World Bank’s Ease of Doing Business Rank benchmark. Singapore has a vast bank infrastructure that comprises more than 150 banks. Five of these are integrated locally, and the majority are multinational. Many of them have international bank account services that are world-class and highest level.

Pros

- Digital Offshore Accounts

- Multi-Currency Bank Accounts

- High Security

Cons

- Limited ATM Capabilities

- Strict Know Your Customers Policies

3.Cayman Islands

The Cayman Islands is an old tax-heaven with an excellent international profile that provides entrepreneurs with many services and business franchises. Moreover, it also has a constitutionally and socially stable climate that encourages everyone to choose it as a destination for their assets.

Cayman policies claim that having no direct taxes renders the Cayman Islands a flourishing center of offshore tax-havens. There are no taxes for capital gains, companies, withholding, land, payroll, sales, or a property investment in the Cayman Islands. The banking system here allows free money transactions in every currency into and out of the islands. No reserve asset specifications exist.

To conclude, there is positive news for small companies that do not possess large liquid reserves. The institutions in the Cayman Islands do not mandate companies to invest a minimum sum of cash. Also, banks in the Cayman Islands do not require significant shareholder disclosures, thereby further protecting their customers’ privacy.

Pros

- Substantial Tax Incentives

- No Direct Taxation

- No Minimum Funds Requirements

Cons

- Your Information Can Be Obtained by Your Country

4.Nevis

Nevis is one of the best options if you’re trying to move your business offshore. They are highly dependent on foreign investment, which drives the economic wheel and increases growth rates. Individuals and companies worldwide choose the islands for their arrangements for asset security, low prices, and high quality.

The government legalizes strong asset security laws; this is particularly true for Nevis LLC, which is fantastic. Nevis businesses have versatile operating frameworks and handling for very few regulatory requirements. No new taxes or legislation exist, and the Financial Services Commissions set reasonable expectations.

For entrepreneurs and customers, Nevis businesses have fantastic advantages. Companies may move to or from other jurisdictions and may combine or integrate with other companies in Nevis or abroad. There are no regulations forcing firms from Nevis to have equity shares. Moreover, Nevis businesses will also place their shares globally on trading platforms, such as:

- The NASDAQ

- London Stock Exchange

- International Securities Exchange

Pros

- No Requirements for Equity Shares

- Protective Provisions

- Global Share Trading

Cons

- Only offers corporations and limited liability companies.

5.Belize

It’s possible that Belize won’t be on the list if you’re hunting for the highest offshore bank account interest rates. Moreover, the quest can disclose nations like Ukraine, which has up to a 20 percent interest rate. However, recession and financial protection are your enemies here.

Ukraine’s inflation is 49 percent. That’s a 29 percent gap that makes it a very low actual interest rate. Ukraine has two big challenges: tax evasion and the weak currency Ukraine. This means that your capital is not really secure and that you will never see that good investment return of 20 percent.

- Why should you choose Belize? Belize has a real interest rate of around 2.54 percent as of this writing; it has an inflation rate of approximately 0 percent, per Trading Economics. However, in comparison to the U.S. and Canada, it is marginally higher than the other nations listed in this report.

Being attached to the USD, the Belize Dollar promises that the currency will not lose its worth immediately. Even though Belize has to suffer a financial crisis, funds invested in offshore accounts in Belize will not see their worth fall. By law, Belize’s overseas banks must have a liquidity rating of at least 24 percent. In comparison, the U.S. Fed has an hourly reserve ratio that for the last ten years has hovered near 2 percent.

Liquidity ratios refer to the percentage of the funds in the treasury of the bank and the loans issued by the banks. Offshore accounts in Belize are one of the best in the world to keep large amounts of capital, considering the high liquidity rates ensured by the government.

Pros

- Higher Interest Rates

- Asset Protection

- Maximum Security

Cons

- Lack of Services for high-value customers

6.Germany

One of Germany’s banks is ranked number one in Global Finance’s most recent ranking of the safest banks. The explanation behind this is the country’s stability, particularly economically. Account-holders can have access to state-of-the-art digital and ATM facilities 24/7 since Germany is a new and established economy. Moreover, to open an account in Germany, you do not have to be present.

The cost of opening and maintenance is typically relatively low. Many banks often sell the alternative of purchasing a Visa or MasterCard credit card. If you love to travel, the advantages are even greater. That is since it can be helpful around Europe to have an account in Euros. Moreover, for regular flyers, certain banks have extra advantages.

Albeit not necessarily overseas, Germany is generally recognized as one of the best ways to save your assets because it offers financial security and security protocols that German banks obey. The services provided by such institutions are much preferable to those offered in other places, so you can enjoy quick access to banking services and low starting costs for bank accounts.

Pros

- Modern ATM Facilities

- Digital Offshore Banking

- Low Account Opening Requirements

Cons

- A lack of privacy

7.Panama

Taking advantage of its geographical location, between the Americas, the Pacific Ocean, and the Atlantic Ocean, Panama has established itself as a financial center on an international scale. It comprises 100 banks that manage nearly $82 billion in assets. With total banking secrecy and without taxes on income from abroad.

Panama is making efforts to take action to remove itself from the list of uncooperative banking jurisdictions, so it has signed information sharing agreements with countries like Singapore in order to appease the OECD. The fact is that nowadays it is no longer easy to open an account in Panama, and therefore banks in Panama are not the best option for Americans and any other nationalities.

Pros

- Maximum Privacy

- Asset Protection

Cons

- Strict Regulations for Tax Evasion

8.Seychelles

A minor nation with a population not exceeding 100,000 is, the Republic of Seychelles, that’s has been one of the top attractions for corporations to set up offshore accounts that the Central Bank of Seychelles will fund. The government does not impose taxes on people and corporations who are non-residents of Seychelles.

Offshore banks in Seychelles will not reveal details about owners and businesses, so it is perfect for those who want privacy and corporate confidentiality. You will also be happy to note that Seychelles is not aligned with the American or European authorities economically or politically.

Companies seeking a high degree of confidentiality would find Seychelles an excellent choice for opening offshore bank accounts. However, shareholders may still need to be mindful of a few countries that signed bilateral tax information-sharing agreements with Seychelles.

Pros

- Maximum Privacy

- Minimum Taxes

Cons

- Bilateral tax information-sharing agreements

9.Hong Kong

I want to remind you that six out of 10 of the world’s top financial institutions are in Asia. Hong Kong is a fantastic location for offshore banking; it’s ranked as the third most competitive financial center globally with an efficient legal system. The reasonable tax system, big banking industry with an excellent telecommunication & infrastructure system make it a perfect international business finance center.

You should know that the process of opening an offshore bank account in Hong Kong is complex a little bit. First, you have to be physically present to open your account. Second, the deposit minimums are also higher than in other countries, and you will also have to attend several meetings before getting to your account. Once you open an account in Hong Kong, you will be able to enjoy top-notch services.

After the current crisis, China’s threat to annex Taiwan, and China’s domination of the island’s political leaders, hot money started to leave. So, we don’t recommend HK as your first choice for any offshore investment.

Pros

- Lenient Tax System

- Best Telecommunication Infras

Cons

- You have to be present for opening an account.

- Higher deposit minimums

10.Vanuatu Islands

Vanuatu has been voted as the happiest place on earth over the past ten years. It is an archipelago of volcanic origin that includes a chain of more than 80 mountainous islands covered in tropical rainforests. The country’s name goes back to the two words Vanua: meaning land or homeland, and the word Tu: It means position, and the two words together refer to the state of the new country.

If you are looking for a tax haven, the Republic of Vanuatu is ideal for you. One of the best things about this Island is that there are no inheritance taxes, multiple exchange controls, and there is no capital gains tax. You will not have to face any strict requirements to open an offshore account because you can remotely open a bank account in the Republic of Vanuatu; only your application form should be signed by a judge for authenticity.

Pros

- Lenient Account Opening Requirements

- Digital Access to Your Account

- Multiple Currencies

Cons

- Higher Deposit Minimums

How to Choose the Best Offshore Bank Option?

Here are some factors to help you choose the best place for yourself.

Reputation

Reputation implies the standard of the jurisdiction and financial system. Remind that a strongly pro-business and secure climate is likely to offer a well-reputed banking nation. To be honest, it can be very difficult to cope with how convenient it is if you open bank accounts yourself in those countries as a foreigner. Typically, as opposed to other nations, owing to the complex criteria, further attempts would need to be taken to establish an offshore account in these areas!

Remote Control Options

Many visitors are big supporters of launching remote accounts since this would make them relatively happy. The biggest draw factor of remote openings is that, like conventional ways, you do not need to arrange to meet the company. You do not need a conference with the bank. Save yourself time and save money!

Deposits

A significant number of people may think of Low Deposit as the dominant reason to find their right offshore bank account, particularly for those being start-ups, entrepreneurs, or SMEs. Any offshore accounts do not even need an initial payment for a bank account to open. On the other hand, certain banks may demand deposit requirements for foreigners, but at a nominal price. However, high deposit minimums are also expected by many captivating banks and banking jurisdictions such as:

- Hong Kong

- Singapore

- Panama

Processing Time

In most situations, based on how convenient it is to open in that specific offshore banking region, the process of opening an account can be completed very easily. The timeline of most offshore bank accounts is quite comparable to one another for the account opening process.

Merchant Accounts

Many e-commerce company consumers are incredibly demanding when opening merchant accounts. For this sort of account to be created, there are unique criteria. Moreover, whether or not you should open your merchant account can also depend heavily on your selection of merchant providers.

Nationalities

Each offshore bank may have its own unique list of countries that are forbidden from opening bank accounts. It is also quite important to look for the suitability of your citizenship and banking policy.

Business Categories

Any countries with offshore banking may favor their local firms. Others may also have something of a bias on the part of some particular market fields, helping them to open a business account quickly.

Conclusion:

Offshore banking may have its critics, but for private companies and individuals alike, it is still an advantageous and legitimate activity. I hope our article help you figure out which tax heaven suits you and if you have any recommendations, opinions we are glad to answer you in the comments section below.